2023

May

Crispin Littlehales, Executive Editor

Crispin Littlehales, Executive Editor

Failing forward

“If at first you don’t succeed, try, try again.” Although no one seems to know who first uttered these encouraging words, it’s certainly a mantra in our industry, where evolutionary progress is the name of the game and even “failures” are viewed as a giant step towards success. One high-profile example is the HAKUTO-R lunar landing attempt. Although the vehicle lost communication just before it’s attempted landing on the Moon’s surface, Takeshi Hakamada, founder, and CEO of ispace, the Japanese company that built and operated HAKUTO-R noted, “We believe that we have fully accomplished the significance of this mission, having acquired a great deal of data and experience by being able to execute the landing phase.

“What is important is to feed this knowledge and learning back to Mission 2 and beyond so that we can make the most of this experience. To this end, we are already developing Mission 2 and Mission 3 concurrently and have prepared a foundation that can maintain this continuity…we will keep moving forward.”

Indeed, HAKUTO-R, which achieved eight of the ten milestones it set out to accomplish including the completion of all orbit control maneuvers in lunar orbit, is expected to pave the way for ispace to realize its goal of being a gateway for private sector companies to bring their businesses to the Moon. Ispace has also been awarded contracts to collect and transfer ownership of lunar regolith to NASA and was selected by ESA to be part of the Science Team for PROSPECT, a program which seeks to extract water on the Moon.

HAKUTO-R is not the only spacecraft that failed forward in the last few weeks. Relativity Space launched its 3D printed rocket, the first of its kind, on March 22. The spaceship survived Max-Q but failed to reach orbit. Tim Ellis, Relativity’s CEO, was nonetheless optimistic. He tweeted, “This will essentially prove the viability of using additive manufacturing tech to produce products that fly.” He also indicated that getting through Max-Q was “the key inflection” for the mission.

SpaceX’s CEO, Elon Musk, was also undaunted after watching Starship, the most powerful rocket ever created, disintegrate four minutes after takeoff. He tweeted, “Congrats @SpaceX team on an exciting test launch of Starship! Learned a lot for the next test launch in a few months.”

In this month’s issue of Satellite Evolution Global, Yuto Shiba, Manager, Product and Consumer Engineering, and Reina Saiki, Business Strategy Officer for Synspective talk about the future of SAR technology.

Laurence Russell speaks with Amelia Liu, the COO for Starwin who discusses the company’s recent successes as well as China’s future in the world of commercial space technologies. In addition, Russell interviews Chris Blackerby, Group Chief Operating Officer for Astroscale who shares his thoughts on how the orbital servicing market is unfolding.

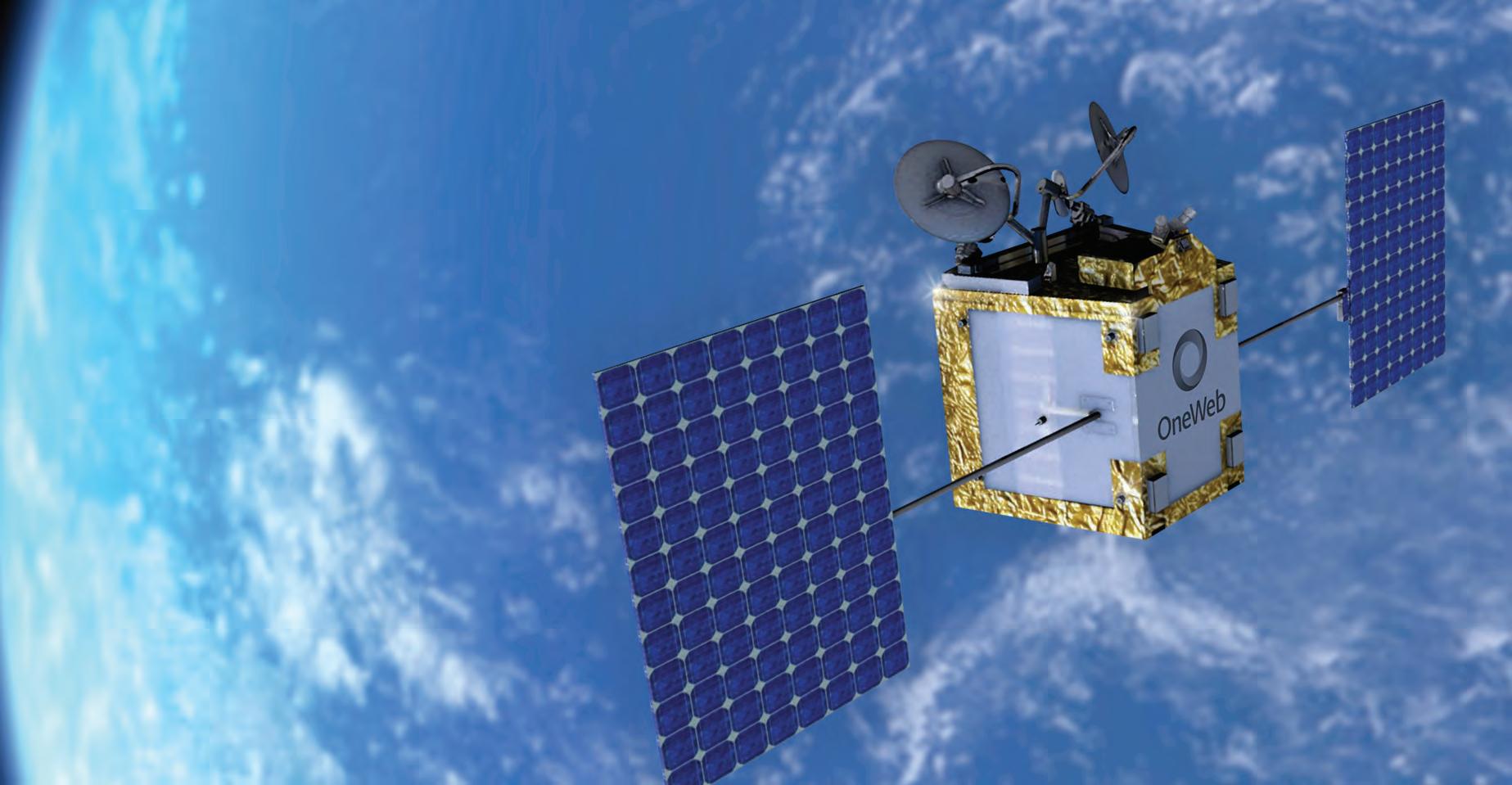

We also hear from Stephen Beynon, CCO of OneWeb, who provides some exciting details about the company’s ambitious endeavors now that they have their full constellation in orbit. Finally, Greg Quiggle, Senior Vice President of Space Product Management at Kratos shares his thoughts about the company’s current and future plans to support a dynamic, software-defined ground segment.

www.satellite-evolution.com | May 2023 3 #SpaceX #Synspective #Kratos #Astroscale #OneWeb #Starwin

Editorial

Photo courtesy OneWeb

Features & Market Reports

www.satellite-evolution.com | May 2023 4 Editorial Contents DS Air Publications 1 Langhurstwood Road, Horsham, West Sussex, RH12 4QD, United Kingdom T: +44 1403 273973 | F: +44 1403 273972 | Email: admin@dsairpublications.com | www.satellite-evolution.com Satellite Evolution Global - May 2023 - Volume 2 No. 4. ISSN: 2755-1326 Associate Editor Laurence Russell laurence@dsairpublications.com Executive Editor Crispin Littlehales crispin@dsairpublications.com Managing Director David Shortland david@dsairpublications.com Publishing Director Richard Hooper richard@dsairpublications.com Publisher Jill Durfee jill.durfee@dsairpublications.com Business Development Manager Belinda Bradford belinda@dsairpublications.com Circulation Manager Elizabeth George admin@dsairpublications.com Production production@dsairpublications.com No part of this publication may be transmitted, reproduced or electronically stored without the written permission from the publisher. DS Air Publications does not give any warranty as to the content of the material appearing in the magazine, its accuracy, timeliness or fitness for any particular purpose. DS Air Publications disclaims all responsibility for any damages or losses in the use and dissemination of the information. All editorial contents Copyright © 2023 | DS Air Publications | All rights reserved Regulars Executive Q&As Satellite News & Analysis 6 Executive Movers & Shakers 36 Q&A Stephen Beynon, CCO of OneWeb 14 Q&A Chris Blackerby, Group Chief Operating Officer, Astroscale 20 Q&A Greg Quiggle, Senior Vice President of Space Product Management, Kratos 24 Q&A Amelia Liu, COO, Starwin 28 #SaudiAramco #OneWeb #Synspective #Kratos #Starwin #Astroscale

The rising satellite radar technology shaking up government and commercial markets - Synspective 10 Will LEO constellations change the connectivity game for the oil and gas industry? - Saudi Aramco 30 The explosive NewSpace potential of Southeast AsiaLaurence Russell 34 Marketing Production Manager Jamaica Hamilton jamaica.hamilton@dsairpublications.com

Hispasat and Intelsat expand their strategic agreement to provide inflight Internet

NORTH AMERICA - Hispasat and Intelsat have reached an agreement to expand and extend the agreement reached in 2019 to lease the capacity on Hispasat's latest satellite, Amazonas Nexus. Specifically, this new partnership includes long-term leasing of the entire satellite capacity available over the United States and Brazil, as well as a significant part of the capacity of the Amazonas Nexus over the North Atlantic corridor. Thanks to this, Intelsat will offer inflight connectivity services in these areas with a high volume of air traffic, as well as corporate and cellular backhaul services.

Adam Troy, VP of Network Partnerships at Intelsat, affirmed that “our long and successful collaboration with Hispasat in providing connectivity services on commercial flights, together with the excellent coverage and flexibility in orbit from the Amazonas Nexus, has led us to sign this agreement which strategically reinforces our offering in the American and Brazilian commercial aviation, mobility and network service markets.”

Ignacio Sanchis, CCO of Hispasat, thanked Intelsat for the trust shown by “this long-term agreement, which

confirms our commitment to the Amazonas Nexus in the connectivity market in mobility environments and strengthens our position in the Americas.”

The Amazonas Nexus is a high throughput satellite, and the innovative architecture will serve to replace the Amazonas 2 in the 61º West orbital position. The new satellite, which was launched on February 6 from Cape Canaveral, will have a payload specifically dedicated to connectivity in mobility environments (planes and ships), in addition to other applications such as corporate communications and cellular backhaul rollouts. Furthermore, it will a launch a state-of-the-art Digital Transparent Processor, a technological innovation that will substantially increase the satellite’s flexibility and make it easier to adapt to the changes that may occur in demand.

Together with the extended long-term agreement with Intelsat, the Amazonas Nexus project includes two other strategic customers during its useful life: Tusass, the telecommunications operator from Greenland, and Artel, which will provide the Pathfinder 2 payload on board this satellite to the American Space Forces. In total, Hispasat has already reached long-term agreements to lease more than 60 percent of the capacity of the Amazonas Nexus, a notable milestone in a market that is trending towards short-term agreements.

This highlights the growth in the demand for satellite services in mobility and corporate services in the Americas. In fact, the demand of capacity of inflight connectivity services is expected to multiply twelve-fold in the period between 2021-2031.

www.satellite-evolution.com | May 2023 6

Satellite News & Analysis #Intelsat #Hispasat #Inflight #Internet

Photo courtesy aappp/Shutterstock

Swedish Space Corporation establishes new Italian subsidiary –SSC Space Italy

EUROPE - Swedish Space Corporation (SSC) has established SSC Space Italy, a new subsidiary targeted at the growing Italian space market. It is a significant milestone for the SSC Group, which strengthens the company’s presence in Europe and reinforces its reputation as a leader in the industry.

“We are thrilled to announce the establishment of SSC Space Italy. It’s a crucial step in the SSC Group global expansion strategy and demonstrates our commitment to global growth and innovation. Italy is an attractive destination for businesses, and we see tremendous potential for development in the region,” says Davide Starnone, Director General of SSC Space Italy.

The formation of SSC Italy marks another significant milestone for the SSC Group. The subsidiary will operate under the Engineering Services division, and provide a platform for the company to expand its offerings and reach new markets.

For the last decade SSC has invested time and energy in strengthening our capacity globally. With the establishment of SSC Space Italy, we emphasize our role as a key player on one of Europe’s leading space markets, and leader in the industry as a whole,” says Stefan Gardefjord, CEO SSC.

SSC Space Italy will be under the management of Davide Starnone who takes the role as Director General of the new subsidiary. Davide brings experience and expertise from his current role as Managing Director of Aurora Technology BV. Supported by the SSC Engineering Services team, he will continue in both roles simultaneously.

Human-made shooting star developer to revolutionize space science with Web3

JAPAN - Space technology company ALE has announced its long-term goal to revolutionize space technology and climate science, with a Web3-mediated decentralized science (DeSci) approach to earth data collection, analysis, space science and more open, collaborative business models. ALE will pioneer the development of new Web3based space science research and development (R&D) to enable a far more efficient distribution of scientific research and policies through decentralized autonomous organizations (DAOs) in the future.

In the first step of ALE’s space science development through DeSci, the company will develop and sell digital content that leverages the appeal of its human-made shooting star project, SKY CANVAS. ALE’s recently launched VIP PASS NFT to the SKY CANVAS Community

Club was the company’s first Web3 initiative, to support the world’s first public human-made shooting star event, scheduled to take place in 2025.

Dr. Lena Okajima, founder and CEO of ALE explains further: “Although it may seem complex to the layperson, the simple idea that drives the concept of Decentralized Science (or DeSci, for short) is inspired by decentralized technologies such as blockchain to enable a more open, collaborative, and transparent approach to scientific research. In order for the scientific and space technology communities bring about positive sustainability actions to combat climate change and protect the Earth’s biodiversity, for example, we need to take a much longer-term view, and to encourage better ways for industry, academia and governments to work together to achieve the necessary solutions.

“Our ambition is to use our human-made shooting star satellite technologies to develop better ways of collecting data from the Earth’s atmosphere that promote sustainable space and climate science research and development. And at ALE we are developing new decentralized Web3-based R&D that requires a mid-to-long term investment. To establish schemes with flat decision-making between industry, academia, and government. Ultimately, what we want to achieve is to increase our understanding of the whole Earth’s activities through the centralization and integration of data.”

Explaining more about the climate and atmospheric science aspect of SKY CANVAS, Dr Gilles Bailet, Research Associate in Emerging Space Technologies at University of Glasgow comments: “In addition to its space entertainment business, ALE is pioneering innovative approaches to fund fundamental science R&D. Through its SKY CANVAS project, ALE aims to collect crucial atmospheric data from the mesosphere, an important layer for understanding climate dynamics . The upcoming ALE3 satellite will play a key role in gathering climate information specifically from the mesosphere, which is situated between the stratosphere and the thermosphere in the Earth's atmosphere.

“The "space entertainment" factor of SKY CANVAS is certainly going to inspire a lot of new interest in space and science, although the scientific value of creating a humanmade meteor shower is that it will enable us to reliably observe particles in the mesosphere. And studying humanmade shooting stars will also help us to clarify various scientific theories about natural shooting stars.”

www.satellite-evolution.com | May 2023 7 Satellite News & Analysis

Photo courtesy Alan Uster/Shutterstock

Airbus selects UK National Satellite Test Facility for SKYNET 6A testing

UNITED KINGDOM - Airbus has selected the National Satellite Test Facility (NSTF) at Harwell in Oxfordshire to carry out the comprehensive test campaign on the UK Ministry of Defence’s next-generation secure communications satellite SKYNET 6A.

The £116 million government-funded NSTF, operated by experts from the STFC RAL Space (Science and Technology Facilities Council), will carry out the SKYNET 6A test campaign, including electromagnetic compatibility, as well as acoustic and thermal vacuum testing, to replicate the harsh conditions of space.

Richard Franklin, Managing Director of Airbus Defence and Space UK, said: “SKYNET 6A is designed and manufactured at our Stevenage and Portsmouth sites and will undergo its entire testing campaign at the new National Satellite Test Facility. It is fitting that the facility’s first testing contract is for Britain’s’ next generation SKYNET 6A, which will provide critical, secure-communications capability for our armed forces and will help further extend the UK’s space ecosystem and capability.”

Ian Annett, Deputy CEO at the UK Space Agency, said: “The National Satellite Test Facility is a significant addition to the UK’s growing space infrastructure that will improve the support available for companies across the breadth of the UK space industry, which employ thousands of people across the country. The brand new facility, the first customer of which will be Airbus Defence and Space, will also help attract new businesses of all shapes and sizes to Harwell and the UK. This will catalyse investment and accelerate the development of new technologies for decades to come – from advanced satellite manufacturing to secure communications, navigation and Earth observation.”

SKYNET 6A will be the first SKYNET milsatcom satellite to be entirely designed, built and tested in the UK. The programme involves a 500-strong team at Airbus and is being supported by more than 45 SMEs across the UK. This geostationary telecommunications satellite will provide secure communications services for the UK’s armed forces around the world following its launch in 2025.

www.satellite-evolution.com | May 2023 8 Satellite News & Analysis #Airbus #SKYNET6A #STFCRALSpace

From left to right: Ian Annett, Deputy CEO UK Space Agency, Matt Fletcher Head of Environmental Test at STFC RAL Space, and Richard Budd, Head of Secure Communications UK, US & Australia, Airbus Defence and Space, at the signing ceremony for SKYNET 6A testing

Vast announces the Haven-1 and Vast-1 missions

NORTH AMERICA - Vast plans to launch the world’s first commercial space station, called Haven-1. Scheduled to launch on a SpaceX Falcon 9 rocket to low-Earth orbit no earlier than August 2025, Haven-1 will initially act as an independent crewed space station prior to being connected as a module to a larger Vast space station currently in development. The mission will be quickly followed by Vast-1, the first human spaceflight mission to Haven-1 on a SpaceX Dragon spacecraft. The vehicle and its four-person crew will dock with Haven-1 for up to 30 days while orbiting Earth. Vast also secured an option with SpaceX for an additional human spaceflight mission to Haven1.

This represents the first time in history that a commercial space station company has both a contracted launch for its space station and a visiting human spaceflight mission.

“Vast is thrilled to embark on this journey of launching the world's first commercial space station, Haven-1, and its first crew, Vast-1,” said Jed McCaleb, CEO of Vast. “We are grateful to SpaceX for this exciting partnership that represents the first steps in Vast’s long-term vision of launching much larger, artificial gravity space stations in Earth orbit and beyond.”

“A commercial rocket launching a commercial spacecraft with commercial astronauts to a commercial space station is the future of low-Earth orbit, and with Vast we’re taking another step toward making that future a reality,” said Tom Ochinero, Senior Vice President of Commercial Business at SpaceX. “The SpaceX team couldn’t be more excited to launch Vast’s Haven-1 and support their follow-on human spaceflight missions to the orbiting commercial space station.”

Vast’s long-term goal is to develop a 100-meter-long multimodule spinning artificial gravity space station launched by SpaceX’s Starship transportation system. In support of this, Vast will explore conducting the world’s first spinning artificial gravity experiment on a

commercial space station with Haven-1. Vast is selling up to four crewed seats on the inaugural mission to Haven-1. Expected customers include domestic and international space agencies and private individuals involved in science and philanthropic projects. Visit vastspace.com/reserve for more details.

SpaceX will also provide crew training on Falcon 9 and the Dragon spacecraft, emergency preparedness, spacesuit and spacecraft ingress and egress exercises, as well as partial and full mission simulations including docking and undocking with Haven-1 for return to Earth.

www.satellite-evolution.com | May 2023 9 Satellite News & Analysis #Vast #SpaceStation #SpaceX

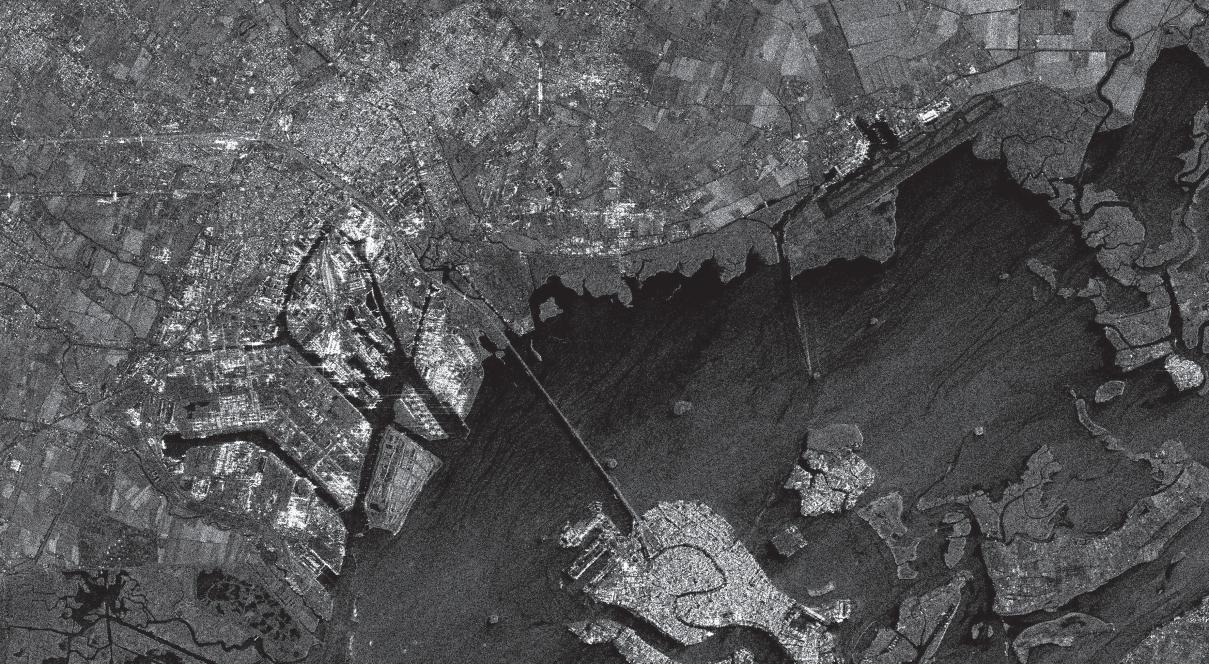

The rising satellite radar technology shaking up government and commercial markets

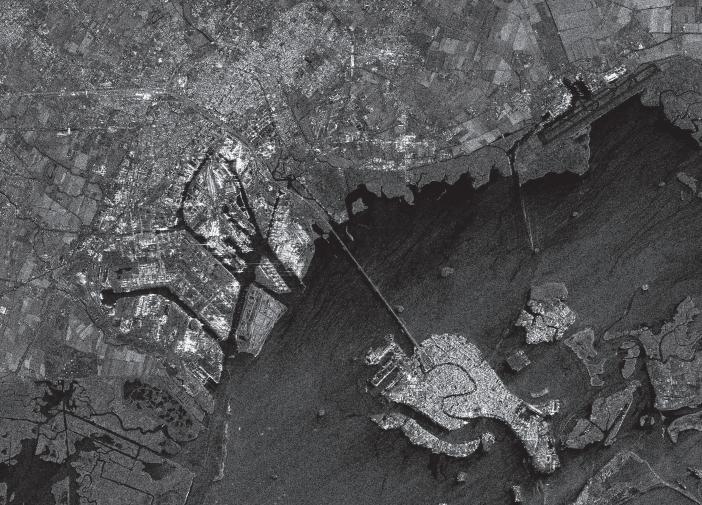

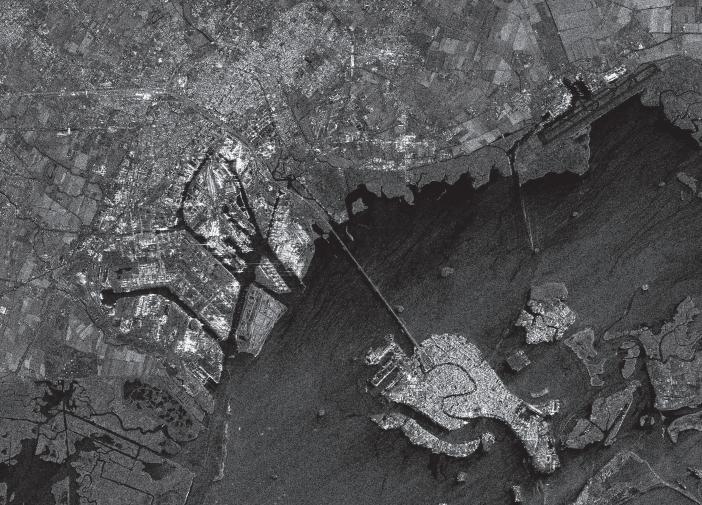

Government agencies and many different commercial industries can benefit from Synthetic Aperture Radar (SAR) which is now readily available. This is because SAR delivers high-quality imagery and data that is critical both to infrastructure planning and disaster relief.

SAR – or Synthetic Aperture Radar – technology is a powerful, growing, and transformative method designed to detect changes on Earth. SAR satellites are unique in their ability to illuminate the ground without being dependent on sunlight like optical observation satellites. They capture an unprecedented level of detail, consistency, and range in imagery.

Not being limited by cloud cover or low visibility at night, SAR satellites provide an unobstructed and informative

view of Earth and ground movements. SAR data contains information that contributes to understanding the shape and physical properties of terrain and structures. It can also monitor objects, such as vehicles in urban cities, buildings in disaster-prone areas, and maritime vessels at major ports. This makes SAR satellites suited to time-series analysis and the capture of continuous changes for a number of applications across land and sea.

Thanks to advances in design and computing as well as falling launch costs, small satellites have become more widely available. Being cheaper and lighter than more traditional satellites, they are increasing access to space. It is now possible to deploy multiple SAR satellites from a single payload. The availability of small SAR satellite constellations makes near real-time observations of the entire planet possible with unmatched details and highresolution image clarity.

GOVERNMENT DEMAND FOR SAR DATA

SAR satellites are informing critical decisions for the benefit of governments. Their observation capabilities are enabling information gathering, communication, and positioning from all regions of the world. This will lead to greater global transparency and will be instrumental in serving defense and intelligence communities in many ways. Detailed and reliable Earth observation data can yield a fuller understanding across human and resource-affiliated conflicts and help defuse them. They can also help governmental and intergovernmental bodies uphold treaties and by locating crimes that take place on land and sea.

Man-made and natural disasters are on the rise. During emergencies, SAR technology detection of changing conditions can provide much needed data and information for decision-making which results in more effective disaster reduction and preparation actions. Governments need to be adaptive and adept at addressing natural disasters and extreme weather activities from flooding and fires to hurricanes. High-resolution SAR imagery can cover the extent and damage of a disaster and be an indispensable source of information both during and after a disaster. In addition, SAR’s unique temporal and spatial resolution is key to developing early warning systems that

www.satellite-evolution.com | May 2023 10

#Synspective #SAR

Reina Saiki, Business Strategy Officer, Synspective

Yuto Shiba, Manager, Product and Customer Engineering, and Reina Saiki, Business Strategy Officer, at Synspective

Yuto Shiba, Manager, Product and Customer Engineering, Synspective

can help identify hazards and improve disaster relief and response efforts.

COMMERCIAL DEMAND FOR SAR DATA

While governments have been the biggest customers for Low Earth Orbit (LEO) imaging, commercial players and applications are expected to grow over the next decade. All-weather SAR satellites and the data they generate are best positioned to develop solutions infrastructure, insurance, and finance. Companies in these areas are interested in the information obtained from SAR satellites and other data sources because they can play a key role in informing strategic decisions. Let us count the ways.

With infrastructure planning, construction projects will be able to use data that highlights potential high-risk areas and advise businesses to build structures capable of withstanding land movement and geological hazards. SAR data can analyze long-term impact and susceptibility to disasters, which can help insurance companies keep pace with global changes, estimate losses quickly, and streamline their payment of claims for customers. In finance, where ESG investing has grown, SAR data can support climate-resilient assets and help institutions measure emissions and nature-based offsets.

CAPTURING THE WORLD, ONE SATELLITE AT A TIME

Synspective, a startup born out of Japan’s ImPACT program, is breaking new ground with its SAR capabilities, and looking to optimize its technologies to meet the challenges of a changing world. The Tokyo-based startup is building a small SAR satellite constellation that will generate data and address bottlenecks for the benefit of governments and commercial customers alike. The company currently has three satellites in LEO capable of

capturing imagery anywhere on Earth. It combines the troves of data that SAR satellites generate with sophisticated machine learning and solution techniques not only to capture imagery but also to enhance the impact of data and meet the demands of existing and potential customers.

Through its growing satellite constellation, Synspective is providing data and analysis services to the industrial sector. Synspective’s proprietary Land Displacement Monitoring (LDM) uses interferometric SAR (InSAR) analysis to monitor ground risks and offer insights into understanding reclaimed lands. For example, land on which mines sit can be examined. Frequent observation using LDM can help track historical changes and find patterns using a cloud-based data platform, allowing organizations to address disasters such as the collapsing of mine slopes or mining-induced seismic events. One of LDM’s features is its subsidence detection, which utilizes a unique algorithm that makes detections by multiplying spatio-temporal changes. It provides advanced warning of potential ground deformations, which can help avert catastrophic incidents in tailing dams and other facilities.

LEO LAUNCHPAD FOR LIMITLESS POTENTIAL

Demand for SAR data will continue to grow, both in the government and in the commercial sector. Synspective is best positioned not only to provide customers with actionable and reliable data, but also to apply data analytic technologies in order to explore the possibilities of SAR with an ecosystem of strategic partners. SAR technology’s full potential has not yet been harnessed. The possibilities it holds are limitless. Synspective aims to continue to discover new ways to use SAR data to help build a more sustainable world and solve its many challenges.

www.satellite-evolution.com | May 2023 12 #SAR #LEO #EarthObservation

Q&A Synspective

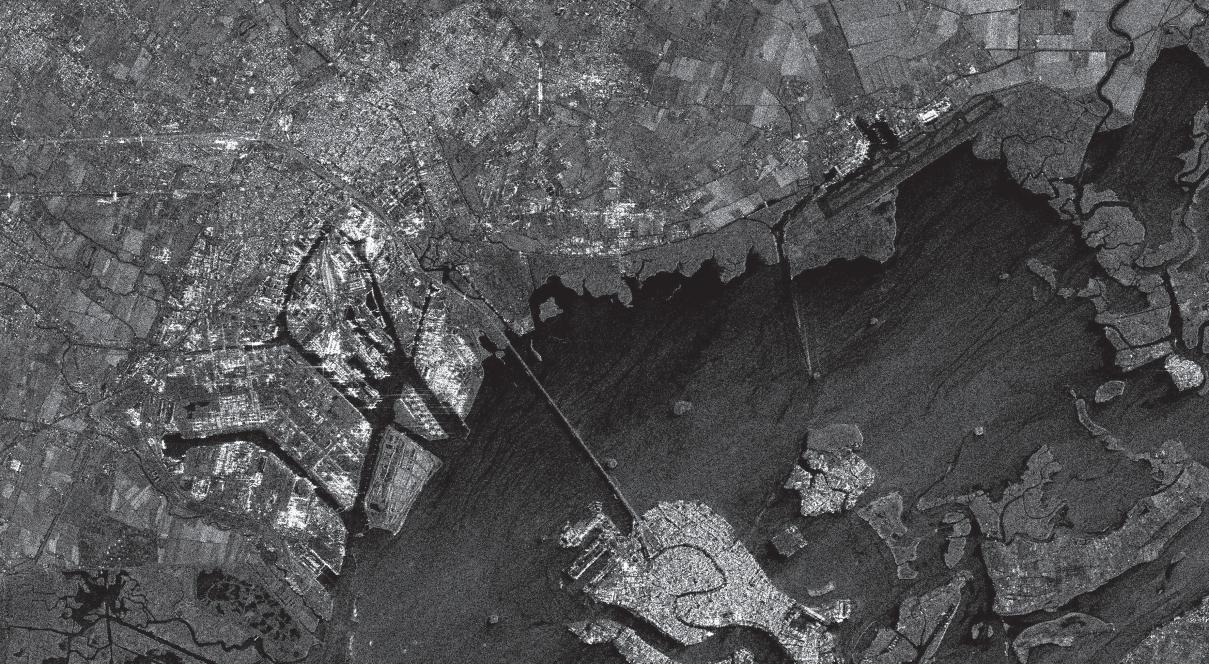

StriX-1 acquired image. Venice, Italy. Photo courtesy Synspective

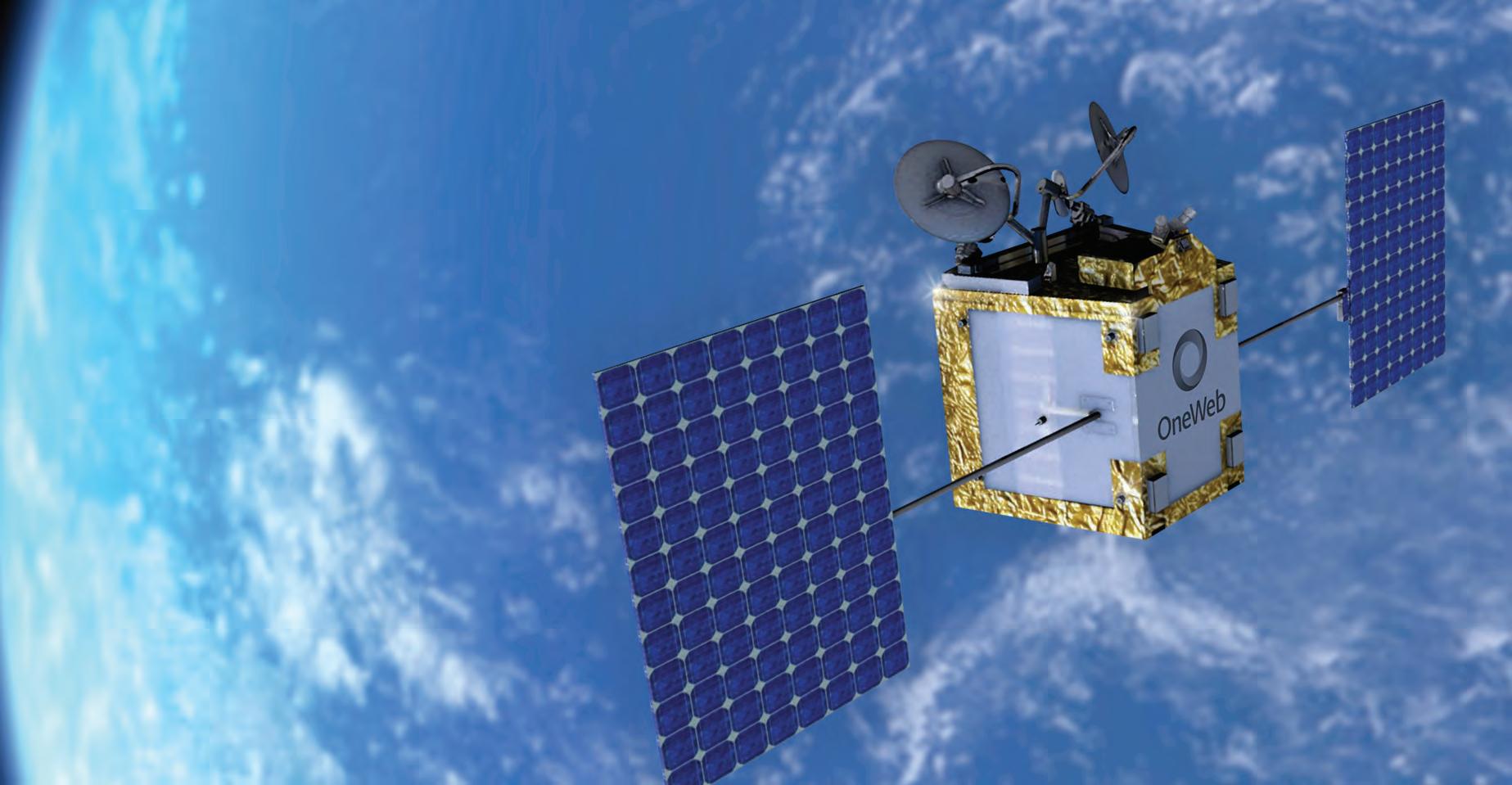

OneWeb gears up to deliver global coverage

After an incredible journey filled with showstopping challenges including a bankruptcy, a pandemic, and a war that swivelled a launch contract with Roscosmos into a $229.2 million impairment charge, OneWeb is now full steam ahead. With 618 satellites in orbit and a merger with Eutelsat in the wings, the company is poised for incredible growth. We spoke with Stephen Beynon, CCO of OneWeb to hear more about the company’s ambitious endeavours.

Crispin Littlehales, Executive Editor, Satellite Evolution Group

Question: What is the status of the Eutelsat/OneWeb merger?

Stephen Beynon: As you know, there are regulatory approvals that are required. Although it is difficult to say for certain, we are expecting the deal to close in the second or third quarter of this year. Then we’ll move forward from there.

We believe that the LEO/GEO combination is what our customers want and that’s the reason that the merger was proposed in the first place. The combination of the low latency LEO and the high-capacity GEO services available anywhere in the world is very exciting for us and we can’t wait to get going. Still there are a lot of decisions we have yet to make and many of those will need to wait until the merger happens.

Question: Can you elaborate on OneWeb’s business model?

Stephen Beynon: OneWeb is a wholesale connectivity provider of products that allow our partners—existing satellite and telecommunication industry players who are serving governments, enterprises, and communities around the world—to build profitable businesses. We want to support them in growing their businesses by bringing LEO to them and enabling them to offer LEO services as part of

www.satellite-evolution.com | May 2023 14 Q&A OneWeb

Q&A

Stephen Beynon, CCO of OneWeb

Satellite Evolution Global

Photo courtesy OneWeb

their overall solutions. We do not go direct to the end users like corporations or governments, we’re a partner. We want to create wholesale products that allow our partners to build profitable businesses, so the price and design of those products is important to us.

Another key plank of what we’re doing is to provide services that have a Service Level Agreement (SLA) behind them with penalties attached. This means if we are not delivering, we will pay a level of compensation – and this distinguishes us from other providers in our space who are providing best effort services. It shows that we care about our partners and will stand behind them. We think that really matters.

If you’re the CIO of an industrial business customer such as a mine site or an oil and gas company, and you’re running mission critical enterprise systems on our service, you need to know that you’ve got an SLA with penalties, because if something goes wrong and you’re running that enterprise on a best effort service, that’s going to be pretty challenging for your internal users. We are very much aiming our service at those customers for whom an SLA is important.

To be clear, we provide a given amount of bandwidth to our distribution partner so they can use it to build the service they want to build. In some cases, they are then contending it to provide a retail service and in other cases, they are providing a corporate grade of connectivity to customer sites where it is vital to have a guaranteed data rate at their location.

Question: What are the use cases for LEO and how does OneWeb see the constellation adding value for customers?

Stephen Beynon: The first category is the corporate and industrial users who need to buy bandwidth with an SLA backed by penalties. That’s already a big market for OneWeb. We have some very interesting customers that are using OneWeb for backup where there is already a primary connection, but they need a resilient connection perhaps across many locations. For example, a distributed retail chain with centers across the US might buy a data pool from a distribution partner so that its 200 locations always have a second or even third line of connectivity because it would be devastating for any of the stores to lose the ability to transact electronic payments.

The second is similar, but instead of protecting the ability to conduct business, these operations are depending on connectivity as a matter of life and death. These are organizations that need to know they can count on the service—often for government or defense applications where resiliency is also key.

The third area, which is massive for OneWeb, is cellular backhaul for mobile operators to allow them to extend their network reach. When a mobile operator acquires spectrum in a country, that often comes with a coverage obligation that requires the operator to reach a specified percentage of the population. Obviously, in some parts of the world that can be quite challenging. What we are doing with our LEO constellation is allowing operators to provide high

www.satellite-evolution.com | May 2023 16

#LEO #Intellian #Hughes #ISRO #Debris Q&A OneWeb

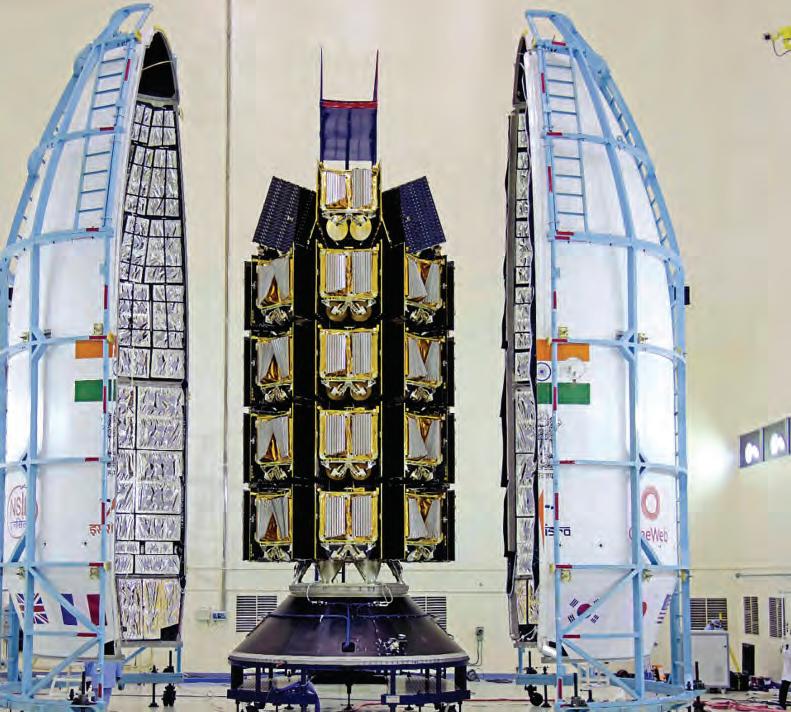

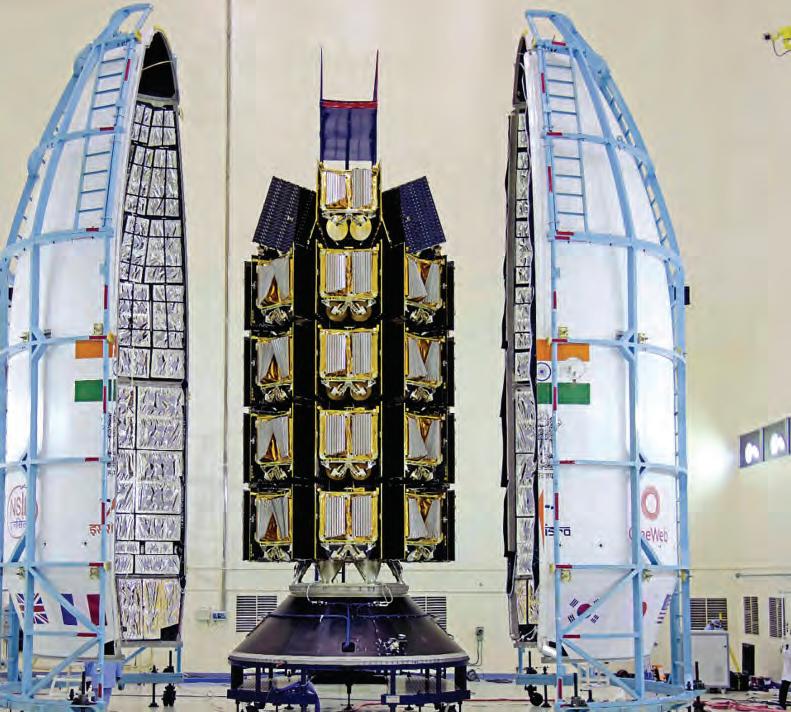

ISRO stepped up and made available to OneWeb its high-capacity launch capability. Photo courtesy OneWeb

quality connectivity to cell towers where it would be impossible to connect in any other way. LEO’s low latency enables users to participate in video chats and do other things that would be very difficult to achieve over GEO.

The fourth use case scenario is remote rural connectivity. Backhaul is a form of that but there are other ways as well. For example, in Northern Canada and Alaska, OneWeb is providing indigenous communities with internet connectivity in a slightly different mode. Our distribution partners put a OneWeb terminal in a remote community and then do the last 10 meters or 100 meters of connectivity with a very low cost fixed wireless connection to households, thereby providing local service. In that case, the distribution partner becomes a retail ISP to those customers utilizing wholesale backhaul.

The fifth use case is all about mobility, meaning maritime and aviation. Again, we are working with partners in the industry and supporting them rather than doing it directly ourselves and competing with them. We just completed inflight testing of a hybrid LEO/GEO connectivity solution with Intelsat where we have been conducting trials over the Caribbean, delivering 200 megabits per second with very low latency. This allows travellers to conduct video meetings on an airplane, which is ground-breaking.

OneWeb’s connectivity is also perfect for maritime merchant vessels to integrate shore processes and port procedures with seafaring operations. Throughout our partnership with Eutelsat, we’ve been supporting large cruise vessels and yachts. Our solutions integrate with existing subsea fiber, microwave, and LTE networks.

Question: Your plan is to serve government bodies, NGOs, and enterprise users with a range of user terminals. How are these terminals optimized to meet the needs of these various customers?

Stephen Beynon: We launched with one primary user terminal (UT) which was the Intellian dual parabolic terminal. That’s particularly suitable for very high

bandwidth use cases which is where we built our business early on. This spring we also started shipping another easy to install, flat electronically scanned array antenna from Kymeta, offering portable or fixed options for use cases and our partners are starting to put these to work now.

Most recently we announced a contract with Intellian for the OW 11FL which is an electronically scanned array (ESA) flat panel user terminal. Because it is more portable, yet still high-performance, the addition of this terminal to our portfolio will significantly expand the situations in which our service can be used.

Last December OneWeb announced the acquisition of 10,000 LEO terminals from Hughes to enable networking services for our government and enterprise customers. These terminals work “out of the box” with a compact indoor (IDU) and outdoor unit (ODU) self-pointing to the OneWeb constellation.

Over the next few months, we will be offering four flat panel alternatives aimed at different uses cases. We also have a ruggedized UT that can be carried on-the-person or integrated on board manned and unmanned tactical ground vehicles to support Communications, Command, and Control.

Question: The successful launch of 36 satellites by the commercial arm of the Indian Space Research Organization (ISRO) and NewSpace India Limited (NSIL) from the Satish Dhawan Space Centre on March 26 was OneWeb’s second launch from India and the final batch needed to complete the constellation of 618 satellites. Can you provide detail regarding OneWeb’s partnership with ISRO/ NSIL and the company’s commitment to provide connectivity across India?

Stephen Beynon: This partnership is particularly important to us because when the war in Ukraine broke out, we had the challenge of finding new launch alternatives. ISRO stepped up and made available to OneWeb its highcapacity launch capability. In October 2022, ISRO/NSIL successfully deployed 36 satellites on the maiden flight

www.satellite-evolution.com | May 2023 17

Photo courtesy OneWeb

of the LVM3 rocket and our second launch from India marked a key milestone to enable global connectivity. That partnership has been critical to our getting back on track after the disruption. It also gives us certainty that later this year, we’ll be able to move from our existing coverage in regions north of 50-degrees latitude to 30-degrees by May and to 25-degrees in August. By the end of the year we go to equatorial, which means full coverage.

To deliver service in India, OneWeb has a partnership with Hughes Communications India Private Ltd (HCIPL), a joint venture between Hughes and Bharti Airtel Limited (“Airtel”). Once all the necessary licenses are complete and the coverage is available, we will launch services with our distribution partner to deliver internet connectivity across India.

Question: OneWeb is also partnering with muSpace to distribute connectivity across Southeast Asia, primarily to remote areas. Do you expect this to be a lucrative market or is it more about connecting the most “forgotten” regions for humanitarian reasons?

Stephen Beynon: When we strike a distribution partnership, we are on a mission to connect those who are unconnected and that includes both consumer end users and businesses. The combination makes it viable to deliver service in these emerging markets. Often there is a level of subsidy available, and we work with our partners to secure different sorts of government funding to enable the delivery of connectivity to underserved areas.

There also are the mobile operators. As mentioned, when they acquire spectrum, they have coverage obligations. They reach increasing numbers of previously

unserved customers by putting towers out there supported by LEO. In doing so, they have a business case to reach these communities because they’re going to provide them with mobile service.

So, there are several different forces that are going to help increase the reach of the internet to these communities and the business customers will help the economics of providing internet more broadly. OneWeb can help stimulate the economic development of these local communities which will then increase their ability to pay and become long term distribution partners and customers, so it all works in a positive way.

Question: Now that the company has a large constellation in orbit, OneWeb has issued a “Responsible Space Advisory” inviting fellow operators to contact the Flight Dynamics Team regarding space safety and collision avoidance. Is this the start of forging an action plan to address these issues?

Stephen Beynon: This is something that OneWeb cares very deeply about and has done so since day one. This is an area where the industry players collaborate well together to ensure that we are doing all the right things. Just to give a flavor of what is happening there, our Fleet Dynamics Team are absorbing data at a massive rate so that we do our best to avoid collisions and conjunctions. In fact, we are bringing in 50,000 pieces of data that relate to potential collision issues each day. We are using AI to sift through all that and identify where and when to act. On average, about eight of those 50,000 items require intervention.

We work with a lot of third parties and very much

www.satellite-evolution.com | May 2023 18 #LVM3

#OneWeb #Debris #Hughes Q&A OneWeb

Photo courtesy OneWeb

encourage the sharing of information and data. OneWeb has an open approach, and we want to collaborate with anybody who is prepared to cooperate because this is in everybody’s best interest.

Question: You recently announced a global agreement with Amazon Web Services (AWS) to explore providing cloud-based connectivity. Is this where you see satellite communications heading?

Stephen Beynon: We want to enable our distribution partners to be able to deploy cloud services easily. A number of them have an existing partnership with AWS and other providers and we can support that but for those who would like to accelerate their ability to offer clouds services, our relationship with AWS is designed to facilitate that. The plan is to work on four key initiatives which include the bundling of connectivity with cloud services and edge computing services; supporting virtual mission operations for customers through integrated and customizable solutions; aggregating and fusing new levels of predictive and trending big data analytics through data lakes to support space and ground operations; and deploying seamless cloud to edge solutions with a LEO connected UT.

Question: 2023 is a big year for OneWeb, but it is only the beginning. Where do you see the company going over the next 1-5 years?

Stephen Beynon: The next five years are all about delivering extraordinary growth both for our partners and for end customers, bringing high-quality connectivity to where it has never been. This is such an exciting time for us because we spent so much time and effort building the

infrastructure and now, we can provide it to people. Then too there is the merger with Eutelsat, a partner with a global reach already at scale. If all goes ahead as planned, we’ll be able to offer GEO as well as LEO which gives our customers another level of capacity and resilient communications.

www.satellite-evolution.com | May 2023 19 Q&A OneWeb

Photo courtesy OneWeb

From de-risking debris to borderless collaboration in orbit

Astroscale is a seminal success story that has become well-regarded in the West. As the disruptive golden child of Japan’s space economy, they’ve made great headway as an agile provider of de-orbiting technologies with great interest in courting the favour of NASA and ESA. Seeking a West-facing assessment of the Asian space market, we spoke to Chris Blackerby, their Group Chief Operating Officer and former NASA attache for the Asian continent to describe what he has seen from the region, and what he expects from it in the future.

Laurence Russell, Associate Editor, Satellite Evolution Group

Question: You’re planning on removing two of the UK’s defunct satellites from orbit by 2026 with your technology, could you outline those plans?

Chris Blackerby: This is a mission we’re working on in collaboration with the European Space Agency *(ESA), UK Space Agency (UKSA) and OneWeb to develop the capability to perform the removal of commercial constellation satellites. In this mission, we’ll be demonstrating our ability to remove multiple defunct satellites with a single servicer.

We’ve already proven much of the technology necessary for this mission through our End-of-Life Service by Astroscale – demonstration (ELSA-d) experiment. We’re now moving on to ELSA-m, with the “M” standing for multiple. Our servicing spacecraft will locate and dock with

www.satellite-evolution.com | May 2023 20 Q&A Astroscale

Q&A

Chris Blackerby, Group Chief Operating Officer, Astroscale

Satellite Evolution Global

Astroscale Engineers with ADRAS-J. Photo courtesy Astroscale

a client satellite that has been prepared with one of our docking plates. We will be developing the capability to bring the object to a lower altitude, release it to burn up in the atmosphere, and then go retrieve another client. Our current model is aiming to perform three removals via a single spacecraft.

Question: We’ve heard great things about the orbital servicing economy’s potential. What do you think it will look like in five years? Will satellite servicing and satellite retrieval be commonplace by then?

Chris Blackerby: Five years isn’t much time, but we’ll see a great range of changes in an industry as fast as this. We’re at the cusp of incredible changes in the economic development of space with predictions that we are moving toward a trillion-dollar space economy in the years ahead, led by advances in industries such as Earth observation, tourism, satellite connectivity and more. These optimistic growth scenarios are going to hinge on a safe and affordable orbital servicing economy.

In five years, we won’t see full market maturity in satellite servicing. We likely won’t have a full squadron of orbital servicers moving satellites and repairing them through automation, or commonplace refuelling platforms in low-Earth orbit (LEO), but we’ll be pretty far along by then. In five years, I am confident that Astroscale will have multiple missions removing debris for both commercial and institutional customers and will be on a clear path to a roadmap that includes these capabilities.

Bringing the demanding applications of commercial orbital servicing to commonplace status will take time. Space is the most challenging physical environment humans have ever explored. Much more can go wrong here than one could expect on Earth.

Looking five years into the future of the world of onorbit servicing is a difficult task, but now we have a space economy where companies are demonstrating the capability for all to see with the intention of bringing it to

market. A lot will change in the next five years.

Question: Experts do not currently see debris as a significant threat, but they recognise that it will be if left unchecked. What do we need to do today to prevent a debris crisis? Will punitive countermeasures for bad actors be effective?

Chris Blackerby: Debris is a very real threat that can’t be taken lightly. Some say we’re already on the edge of a Kessler Syndrome event – the exponential increase in debris that will occur as a result of cascading collisions.

Astroscale has identified three key aspects of solving this problem: policies, technology, and business strategy. To make these processes reproducible, we will manufacture satellites with removal from orbit in mind. To support this effort, we propose applying our ferromagnetic docking plate which allows any satellite to be more easily serviced and removed. This technology could become more commonplace within the next five years, much like how seatbelts were first optional in cars before becoming a standard safety feature. OneWeb has already included docking plates on nearly all of the hundreds of satellites they have in orbit, which has taken steps to set a de-facto standard for the industry.

However, the problem of space debris from the last century still exists. These debris objects cannot be captured with a magnet and governments should take responsibility for the removal. There are still two or threeton rocket bodies spinning in crowded orbits, posing constant risks.

To address this issue, we need government investment in technology, as well as changes in regulation. As associated technologies are still being proven, government support is essential.

There are also dedicated groups, such as CONFERS, that focus on developing practices and standards for servicing. With about 60 company members and government observers, CONFERS is the industry group that

www.satellite-evolution.com | May 2023 22

Astroscale Management with ELSA-d. Photo courtesy Astroscale

is working to address this critical issue for the good of society.

Question: How would you summarise the contemporary Asiatic space economy to a Western reader?

Chris Blackerby: I would say burgeoning and expanding. Before joining Astroscale, I was the NASA attaché for the region based in Tokyo from 2012-2017. During this time, I witnessed the momentum for these technologies gain speed as space agencies formed and plans were put in place.

The Philippines and Vietnam started their own space agencies during this time, while Thailand, Indonesia and Malaysia accelerated spending on existing programs. Japan has been one of NASA’s most reliable partners in space, and South Korea and Singapore are both increasing activities. Furthermore, China and India are rapidly increasing their capabilities.

Question: Astroscale is a disruptive success story based in Japan, one of the world’s leading tech centres. Is the company’s story emblematic of the country’s approach to the NewSpace economy, as a complimentary, and disruptive hub? If so, would you say other NATO-aligned tech players like South Korea and Singapore possess similar models or do either significantly differ?

Chris Blackerby: Astroscale was actually founded in Singapore by Mitsunobu Okada in 2013. After raising initial capital, he opened an R&D facility and head office in Tokyo where we have enjoyed significant government support. A vibrant startup community of talented space entrepreneurs has developed in Japan during the last ten years.

Question: With economic heavyweights China and India demonstrating their aspirations as primary space economies executing significant space exploration efforts, as both are experimenting with increasingly

capitalist strategies is there a chance either might become more like ESA or NASA in the years ahead, in the interest of creating a more insular Asiatic space economy?

Chris Blackerby: NASA and ESA are different models of space organizations. NASA is a national program, while ESA is a coordinated effort among multiple countries. Both models are possible, but the former is more likely. Of course, China and India are already active space powers with their launchers, hundreds of satellites, and landmark scientific programs. China even has people living and working in space on their own space station. While it’s possible that countries could develop regional alliances and budgets similar to ESA, that will be difficult.

That said, both Japan and China are leading regional groups focused on cooperation in space. Japan heads the Asia Pacific Regional Space Agency Forum (APRSAF), and China created the Asia-Pacific Space Cooperation Organization (APSCO). While some countries are members of both alliances, they are separate groups. APRSAF is coordinating activities across various national entities, while APSCO aims to create more regional space programs. It will be difficult to match the success of ESA, which benefitted from the overall cooperation and consolidation of European nations.

Question: In your opinion, what will the Asian space economy look like ten years from now?

Chris Blackerby: In a word, vibrant. The space economy is going to be global and shared.

We can be certain that Asia will be a significant contributor to this expanding global space economy. As this market grows and space is increasingly more congestive, we have to take steps now to assure it is sustainable. Our orbital environment is precious and is at ever-growing risk. A cooperative and stable environment will require a safe and reliable satellite servicing ecosystem to avoid the snowballing risk of orbital debris.

www.satellite-evolution.com | May 2023 23

Q&A Astroscale #NASA #Asia #Debris

Digital transformation of the ground segment

Kratos’ vision for the digital transformation of the ground segment began a decade ago with the Earth Observation (EO) market and is now delivering for SATCOM as well. In 2020 the company introduced its OpenSpace platform which provides orchestrated virtual network operations. Today more than 100 networks deployed around the world use some element of OpenSpace, and the company has been collecting new customers for SATCOM, including Intelsat and US Government programs. We spoke with Greg Quiggle, Senior Vice President of Space Product Management at Kratos to learn more about the company’s current as well as future plans to support a dynamic, software-defined ground segment.

Crispin Littlehales, Executive Editor, Satellite Evolution Group

Question: How has Kratos transformed over the years and how would you describe it now?

Greg Quiggle: Kratos has been in the space industry for about 30 years. Kratos has a very large position in the market—both with US Government and with the commercial satellite operators—doing everything from signal monitoring, satellite command and control, and networks to service management and more. You’re hard pressed to find a satellite flying today that Kratos doesn’t touch in some way.

We’ve seen significant innovation and huge bandwidth increase

www.satellite-evolution.com | May 2023 24 Q&A Kratos

Q&A

Greg Quiggle, Senior Vice President of Space Product Management, Kratos

Satellite Evolution Global

Image courtesy of Kratos

across Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). Even the life cycle of the satellite itself has changed. What was once 15 to 20 years is now five to seven years. These changes have motivated Kratos to address evolving needs, viewing the space and ground segments as one unified space network.

For example, not long ago, we acquired antenna company ASC and that’s a good indication of our increased attention to the network. This was a great addition for us, and we now have a prevalent market share for gateway antennas around the world.

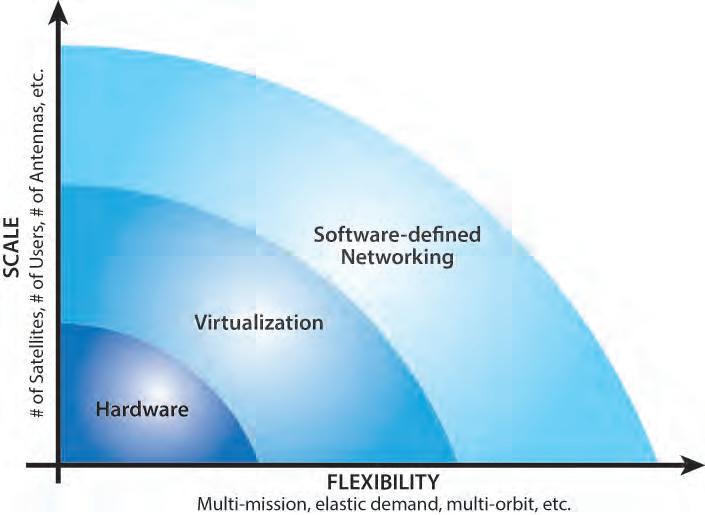

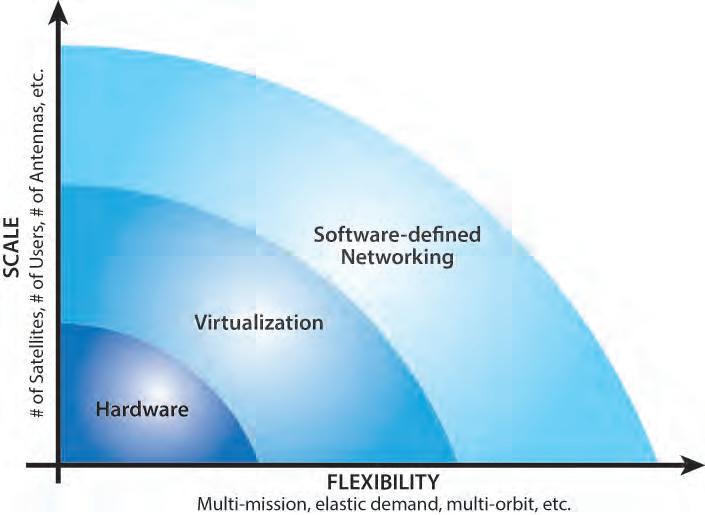

Question: Kratos’ vision for the digital transformation of the ground segment began a decade ago with the EO market. How has that vision evolved?

Greg Quiggle: We started with EO, largely because the value proposition resonated right away and because it is an extremely important area for our government customers. If you think about an EO network, they’re typically LEO satellites that can take image data or signal data from many different spaces on the Earth to create a picture that is not just a static snapshot. With a typical EO network, you only see the satellite from a fixed ground station for very short bursts of time.

Before virtualization, you had this dynamic where operators would build large ground stations of expensive hardware that were vastly underutilized. Virtualization enabled the use of a generic antenna. Then, as a satellite comes over the horizon, you could deploy a virtual network that would allow you to take advantage of the satellite contact that’s required. The network is only active for the period that the satellite goes from a rising horizon to a falling horizon. As a result, that ground station becomes multipurpose. This means it can be used for many different types of satellites, as opposed to just one, and that allows the utilization of the network to go way up. What’s more,

over the last five years or so the cloud operators started to get involved. The cloud can be used to spin up and spin down networks as needed.

So, we started there in order to define and build the core architecture for OpenSpace, starting with virtualization of hardware components. As EO networks get bigger, operators must deploy these virtual modems at much larger scale. As networks grow from a handful to hundreds, scalability becomes essential, and it is important to incorporate orchestration as way to automate the virtualized network. Orchestration is also essential for SATCOM applications, especially at scale, and we are delivering that now.

Question: In 2020, Kratos introduced its OpenSpace platform. Who is using OpenSpace today and what are the characteristics of the platform that make it so appealing?

Greg Quiggle: Kratos was the first to employ a virtual satellite modem and we’ve been virtualizing satellite network elements for about a decade as part of our OpenSpace quantum product line. The OpenSpace Platform was created as a way of taking those virtual modems and bringing them into a framework that allows the operator to orchestrate them at scale. Many operators are starting to convert to the OpenSpace platform to take advantage of these orchestration capabilities. There are also large deployments because of the cloud operators such as Azure Orbital and Amazon Web Services (AWS). Intelsat has also selected the OpenSpace Platform to support its next generation Software Defined Network.

We have also signed some significant deals with the US Government involving satellite command and control and satellite downlinks. The value proposition of virtualizing the network and then orchestrating it in real time resonates where things like multi-mission networks become very

www.satellite-evolution.com | May 2023 25

Photo courtesy greenbutterfly/shutterstock

important. When everything is done in software, you can dynamically configure that software on a momentary basis to fit the need of the mission or the satellite network that you’re using. This becomes more and more critical as networks have advanced to multi-orbit constellations, each requiring support for unique ground network configurations. Instead of having your ground station lay idle for all but 90 minutes of the day, you can do all of this orchestration—handing off and downloading and uploading—and get much more use out of that big ground station antenna. Instead of having racks of equipment dedicated to each satellite, all the uniqueness associated with each satellite is implemented in software, making the network very flexible and dynamic.

You can also distribute the network anywhere in the world. For example, the antenna could be in Australia where some degree of signal processing is done. The remainder of the processing can then be accomplished in Europe. In addition, having the network built in software makes it possible to adapt it to any changes. This is particularly helpful in military applications where the threat profile can change rapidly. In such cases, the network can be reconfigured and repurposed very quickly. It is also able to interact with Artificial Intelligence (AI) and Machine Learning (ML).

Question: How does the dynamic ground benefit operators and users?

Greg Quiggle: It used to be that when you launched a satellite, its payload would be in a fixed configuration for 15 years which meant that the coverage beams would be predefined. If an operator predicted significant demand over Brazil, for example, and that guess was wrong, the operator would have an empty beam over that 15-year period. With software-defined satellites it isn’t necessary to predetermine that beam footprint because it can be reconfigured to match utilization. Reconfiguration of the beams directly effects the way the ground system is configured. If the ground system contains racks and racks of hardware, it cannot adapt quickly to changes so the satellite is underutilized because the ground cannot keep pace. But with OpenSpace, the ground system can react dynamically. We currently have a customer that has a vision of reconfiguring every 15 minutes. When you think about it, we’ve gone from 15 years to 15 minutes.

The other big advantage centers on satellite connectivity to customers. When you make the ground system software-defined and fully orchestrated it enables better integration with telcos and cloud operators. Over the last 10 years the telco networks have virtualized and orchestrated their infrastructure significantly. You now have this very capable telco network and a very capable satellite that’s equally as dynamic but a hardware-based ground system in the middle can become a bottleneck. When you make it software-based and virtualized, however, it can react to changes on the satellite. In addition, it can integrate more easily into the existing telco network which lowers the bar for them to want to leverage satellite data.

In many cases today, the telcos will use SATCOM, but they see it as a last resort, rather than as a primary

technique. That’s really part of Kratos’ mission. Our challenge is to mainstream satellites a core part of how global telecom operators deploy their networks.

In government, there is a huge push to establish multimission networks. Historically, there were racks of equipment behind the antenna for each mission. What digital transformation, virtualization, and orchestration enables is not just to have a generic computer network behind the antenna, but also to satisfy the needs for different missions by configuring the software dynamically. What’s more, a software-defined network can be set up with a zero-trust security framework. Because it is dynamic, the network is regularly reconfiguring itself, changing its attack vectors, and associated ingress points. This makes it very hard for an outsider to be able to penetrate it. In addition, many of the tools that have been developed of the last 20 years to secure an IP network can be immediately applied to a software-defined ground system. Finally, these networks can be updated nightly.

Question: The company announced some new capabilities at Satellite 2023 including OpenSpace VStar and OpenEdge. How are these offerings going to enhance the ground segment’s ability to accommodate today’s more sophisticated space layer?

Greg Quiggle: We chose to expand the footprint for OpenSpace to include SATCOM. OpenEdge satellite terminals extend the dynamic operations of the OpenSpace platform out to the network’s far edge. Signal processing and other value-added network functions happen closer to the end-user. This enables service providers to deploy new services in minutes while reducing the overall lifecycle cost of their network.

The vStar is a commonSATCOM topology. It’s a point in the network that broadcasts to many remotes while listening to what each of those individual remotes has to say. We’ve built a fully virtualized version of that which replaces traditional hardware-based solutions, often referred to as hubs, with a virtualized implementation that runs on software.

Question: Where is the ground segment in terms of being ready to take full advantage of multi-constellation networks and software-defined satellites? What are the key challenges remaining?

Greg Quiggle: As you would expect with a new concept like this, you see pockets of acceptance and pockets of resistance. Some use cases lend themselves very heavily towards a software-defined ground system. A good example of that is occasional use service like disaster recovery. A tornado or flood hits and there is an immediate need for teams of people to be connected for a set period, let’s say weeks, and then they are done. If the dynamic ground or virtualized network is running on a public cloud and the bandwidth is allocated on short notice, it’s possible to spin up the network the day before you need it, pay for it while it is in use, and then spin it down when the need passes.

Another example is satellite news gathering where the reporter shows up for an event and needs satellite connectivity just to cover the event. Military operations also

www.satellite-evolution.com | May 2023 26

#GroundSegment #Software #Satcom #Networks Q&A Kratos

benefit. If all the networks are hardware-based, it’s very difficult to have one in place on short notice.

On the other hand, if you have an ATM network in Southeast Asia that has 5,000 sites that are connected every day, that traffic profile is more static. While there are still benefits, they may not be enough to warrant migration of the traditional technology. Similarly, the satellite operator that has a traditional satellite with a fixed payload and elongated lifecycle is unlikely to feel the pressure to change.

That said, there is a lot of momentum right now around software-defined satellites. Kratos has been public about its relationship with Intelsat. Their new fleet of GEO satellites are software-defined so they want to have ground systems that can react dynamically. In that situation, it is less about use cases and more about the satellite itself being dynamic.

Question: What are the company’s plans for building the dynamic ground segment in the next 1 to 5 years?

Greg Quiggle: There are a couple of themes which are front and center. We will be continuing to develop OpenSpace and we will strengthen our position in the ecosystem though partnerships. A key part of driving success with the platform is the breaking down of stovepipes, leveraging standards, and broadening the ecosystem.

This starts with doing things like making antennas

digital. Kratos is working with many antenna providers to put OpenSpace digital interfaces inside to transition from analog to digital.

Another way we plan to broaden the ecosystem is by working with other applications that run in that same generic compute environment. Think of the way your mobile phone works. You can play music, take pictures, read the news, participate in meetings and all sorts of other things on that one device. That’s because all the applications are virtualized. All these stove pipe use cases have historically been in a ground system or satellite teleport, and we want them to be converted to software and run in a common environment. For example, we recently announced a partnership with XipLink whereby Kratos will enable XipLink’s XipOS network acceleration product to run on our OpenSpace platform as an orchestrated, cloud-native software module.

That’s a key part of the next one to five years for Kratos, the ability to create an expanded ecosystem with more and more partners. When you do that, the industry grows, and the economics become way more meaningful. For the operators, the cost of the networks goes down which then makes it way easier for expansion because the rates for bandwidth go down as well. Then you have a ground system that can scale to that increased demand. What will end up happening is that the space industry will be a much bigger part of the overall communications industry and that’s good for all of us.

www.satellite-evolution.com | May 2023 27

Q&A Kratos #DynamicGroundSegment #Ecosystem #SoutheastAsia

Photo courtesy Illus_man/Shutterstock

What is China’s future in commercialized space?

Through geopolitical hesitancy and trade wars, the West has long kept a complex relationship with China. Though this indecision hasn’t waned quickly, the realities of global economics have been quick to discard old tensions in the interest of mutual growth. As the second largest economy in the world, China hasn’t missed out on the NewSpace boom, with companies such as Starwin participating in its growth. Speaking to Amelia Liu, the company’s COO, we discussed Starwin’s recent successes, and China’s future in the world of commercial space technologies.

Question: You opened a new R&D office earlier this year to support the design of satcom innovation. What will you be working on at the facility in 2023?

Amelia Liu: Our new R&D facility will focus on the design of electronically steered Ka and Ku-band hybrid terminals for multiple applications under multiple orbits, as well as flat panel terminals for Comms on the Pause (COTP) and Comms on the Move (COTM).

We envision this new wave of agile products serving an increasingly integrated market with ever diversifying needs.

Question: Could you describe the private Chinese SATCOM market to Western readers, in your own words?

Amelia Liu: In China, it’s chiefly the government sector and government-

www.satellite-evolution.com | May 2023 28 Q&A Starwin

Q&A

Amelia Liu, COO, Starwin

Satellite Evolution Global

Starwin ESA Terminal production line

Laurence Russell, Associate Editor, Satellite Evolution Group

owned enterprise that makes use of satellite technologies, serving the good of the public by providing support for emergency search and rescue, disaster relief, public security, scientific research, heavy industry, and energy. Today, privatized satellite technology remains uncommon, just like in America during the mid-20th century, but that’s beginning to change.

Companies like Starwin and a growing disruptive startup sector have been showing results, just as NewSpace businesses have worldwide, and its legitimizing space in the economy for more commercial uses of space.

Question: Starwin has achieved quick and consistent growth in recent years. How has it managed to achieve that?

Amelia Liu: Starwin owes these strong results to our leading strategies and unique company culture which have enabled us to accelerate our operation while evolving in step with the changing nature of the contemporary SATCOM market. Our people are motivated and hardworking, led by an optimized management structure that nurtures them to produce the highest results.

A strong product base fed by a devoted research and development branch have been the bread and butter to succeeding at home and abroad, leading to a strong relationship with our partners and end-users.

Question: Despite large efforts toward privatization, China’s efforts in space have largely been fuelled by the state. Do you foresee CNSA following the progress of NASA, as the wider economy has, and begin relying on private developers of space and satellite technology?

Amelia Liu: As I see it, the Chinese National Space Administration (CNSA) is simply our counterpart to NASA. These organizations have more in common than many Westerners realize. They are both government agencies encouraging private enterprise to participate in space technological development in the interest of better serving mankind.

China has a long economic history of state-based industry, much of which remains today, but a lot has changed in recent decades and our country has changed and grown. Hopefully, that will become more apparent as new economic realities stabilize, and we can all rely on deeper cooperation in the interest of a better world for all.

Question: What do you feel businesspeople in the West misunderstand about the SATCOM industry in China, and Asia more widely?

Amelia Liu: Never before in history has the West seen such expansive economic interdependence within the Chinese economy. We share goods and services under mutually beneficial terms on a colossal scale such that our successes as independent nations are tied to one another’s.

China is big market. It’s the Earth’s second largest economy with the potential to one day be the first. It’s an economic inevitability that a businessperson would conclude that there’s money to be made here to our mutual benefit, and that is to be welcomed. China

reciprocates when it reaches out to the world. It’s my hope that these alliances and dependencies can exist on a basis of mutual respect as well as mutual benefit.

Question: Some economists suggest the 21st Century will be “Asia’s century”. Do you believe that will be the case?

Amelia Liu: The population of the Asian continent comprises about half of the population of Earth, being the largest continent of the planet. Those individuals who are driving economic growth in Asia have proven themselves to be ambitious, innovative, and very hard working, which has led to all manner of favorable consensuses around future growth.

I would like to think the people of Asia are peace-loving, and eager for a harmonious relationship with the rest of the world. Nothing grows a world like peace does, so there are rarely many incentives for conflict, economic incentives least of all. It’s far too early to say what the course of this century will be, but whatever economic milestones or advantages might be earned, they are plainly not worth going to war over, as some might fear.

www.satellite-evolution.com | May 2023 29 Q&A Starwin #Terminals #China #SATCOM

Starwin Terminal production line

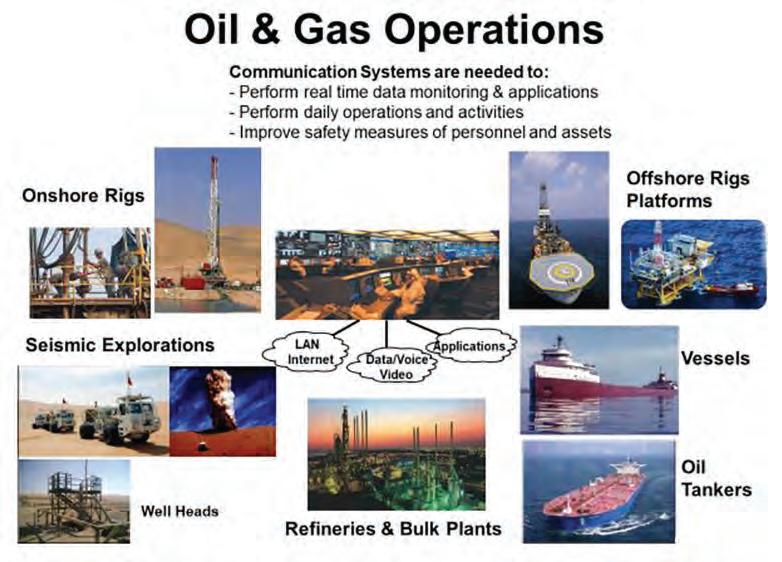

Will LEO constellations change the connectivity game for the oil and gas industry?

GEO and LEO satellites provide the same services: voice, video, and internet to specific areas around the world. LEO satellites have become increasingly popular as a result of new innovations and advancements in the industry over the last couple of years. The technologies and proximity of LEO satellites can offer a higher speed and lower latency connection which might well prove to be the perfect combination for the oil and gas industry.

Mohammed A. Aljaroudi, Communication Specialist, Saudi Aramco Company, Saudi Arabia

Iremember that when I joined the company - one of the largest Oil and Gas companies in the world in the early 1980s, High Frequency (HF) radio systems were used to provide radio voice connectivity between the onshore/ offshore remote operations and their control centers. Then the Very High Frequency (VHF) extended subscribers system was introduced to provide voice telephone services which used to require excessive and expensive field trips and visits to realign the antennas, once the drilling rigs were moved to another new drilling location.

In the early 1990s, as the demand for reliable and higher data speeds increased, the Inmarsat satellite system was introduced to provide voice and limited data connectivity of 9.6 kb/s and then 64kb/s. Then ten years later, I-Fields were introduced into the industry. These required much higher data speeds and therefore, Very Small Aperture Terminal (VSAT) services based on GEO satellites were introduced to provide 2 mb/s data connectivity. These services are still in use today.

GEO satellites, which are still dominating world satellite communications, have been in operation for almost 50 years and are providing multiple onshore/offshore daily communication connectivity and services like wideband/ narrowband VSAT, TV, mobile, airplanes and backhaul systems and services.

Today the demand for much higher data speeds for oil and gas operations is growing to meet the digitization transformations and GEO satellite systems are barely meeting this demand. Hence, Low Earth Orbit (LEO) satellite systems might be the optimal solution to meet and satisfy this demand. LEO satellite systems are not new

to the market. The introduction of LEO concepts was attempted in the 1990s, when several companies tried to provide global connectivity at LEO – companies such as Globalstar, Iridium, Odyssey, and Teledesic. In the end, however, all but Iridium scaled back or canceled their intended constellations because of high costs and limited demand.

All suffered financial problems. After that experience, many industry analysts and investors remain skeptical about the viability of large LEO constellations. Teledesic for example was established to deliver internet service over satellite through a constellation of 840 LEO satellites. But due to the expensive satellite manufacturing and launching at that time as well as expensive end user devices and limited users, Teledesic’s plan failed. These days with the advanced nano technology to manufacture satellite systems and end user devices at a lower cost, coupled with increased demand for higher download internet services, Teledesic might have succeeded.

GEO VS. LEO

GEO satellites are located above the earth at a very high altitude—about 36,000 km (22,200 miles) above the equator. They rotate around the Earth in about 23 hours, 56 minutes and 4 seconds. The Earth rotates around its equator every 24 hours. Since there is no earth gravity impact at GEO altitude, the GEO satellites appear fixed to any position or location in the ground. Because of the high altitude of GEO satellites, the time delay or latency of these satellites is about 650 ms which impacts real time interactive voice and video traffics well as playing interactive games on the internet. But for other services like the TV broadcasting this high latency is not an issue. Placed at high altitude, 3 GEO satellites are enough to cover the world’s population and 3 control ground stations are needed to control the GEO satellites. All TV broadcasting and VSAT services are currently working on GEO satellite systems and will continue for a while.

www.satellite-evolution.com | May 2023 30 Oil & Gas Industry #LEO #SaudiAramco #GEO #Connectivity

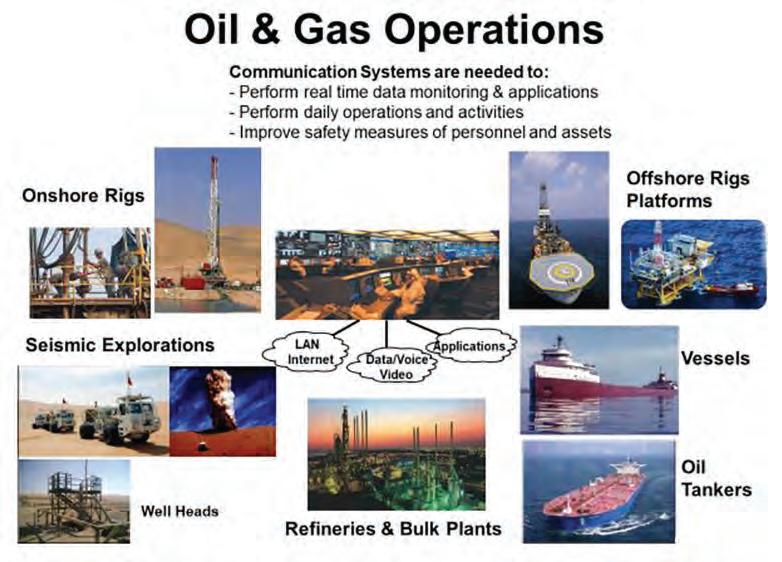

Figure 1 – Different types of remote oil and gas operations served by satellite systems

LEO satellites, on the other hand, are located and operated at altitudes around 1,200 km (750 miles) compared to 36,000 km (22,200 miles) of the GEO. The LEO constellations have much lower latency, in the neighborhood of 25 – 35 ms. Moreover, LEO satellites use various techniques such as spot beams and frequency reuse to significantly increase capacity and deliver higher bandwidth rates to users.

Due to the pull of Earth’s gravity, LEO satellites move at extremely high speeds. They rotate around the earth every 90 minutes and, as a result, each constellation requires hundreds of satellites to cover the entire globe and provide continuous connectivity for any given area. The low latency of LEOs compared to GEO satellites is a key factor and considered an advantage. It plays a major role in applications that require real-time data control and monitoring, such as voice over internet protocol (VoIP), surveillance and imaging, telemedicine, and remotecontrolled machines.

LEO SYSTEMS AND COMPANIES

With satellites becoming easier and cheaper to build and launch, many private companies now have the opportunity to join the space market and provide high-demand services for individuals, businesses, research institutes and government organizations. There are currently several companies that provide communication services through LEO constellations including SpaceX’s Starlink, OneWeb, LEOSat, OQ, and Telesat. These LEO constellations are designed to offer high speed, low latency broadband services to underserved regions of the world. Starlink is one of the most well-known LEO broadband providers. The company currently has more than 2,300 functioning satellites in orbit and is planning to launch 4400 satellites. Typical speeds offered by Starlink range between 20-100 mbps download and between 5-15 mbps upload. SpaceX says it will be able to provide broadband service up to 1 Gbps for the end user.

OneWeb has launched 618 LEO satellites. Telesat, with a proposed initial constellation of 117 spacecraft, is planning to deploy more than 500. Amazon is also an up-andcoming competitor with their Project Kuiper with a planned 3,236-satellite constellation in low earth orbit.

Due to the failure of the first LEO systems introduced in the 90s, a question might be raised now, will these new LEO companies succeed? Before this question is answered, it’s worth mentioning that dramatic improvements have taken place in communication technology since the 1990s and there are two main factors considered in the satellite industry. Nowadays, the satellites are smaller, lighter, and less expensive to manufacture and launch compared to past. These improvements make it easier for LEO satellite operators to succeed.

Also, there have been changes in the end user devices. At the time of Teledesic, for example, most tracking antennas were parabolic based, which means mechanical antennas rotating on various axis in order to remain pointed at the satellite. If more than one satellite had to be tracked, there had to be more than one antenna. New flat panel antenna (FPA) technology is capable of tracking multiple

satellites at the same time, using a laptop cover sized antenna that may be mounted both on fixed and moving targets including homes, businesses, buses, trains, planes, and boats. Massive production of these end user devices bring their prices down as well. Moreover, these antennas will be easy to install, unlike traditional VSAT parabolic antennas that have to be carefully aligned and pointed to the satellite.

Another promising factor for LEO satellites is the high demand for high-speed internet. Back in the 90’s during the Teledesic project, the internet was just emerging. Today people are trained in the use of smartphones and laptops, and everyone is connected to the internet for everything from business to entertainment, to socializing, to the IoT or “Internet of Things” in which everything is connected to the internet.